Many companies take a serious look at central production. The prospect of better consistency and the opportunity to run larger batches lure too many of these companies into a trap. Recently, I observed the final meetings for a single unit operator expanding to a new commissary with capacity to handle production for 5 additional units. The owner wanted a new control system to handle the increased demands of his expanding business.

Unfortunately, it was far too late to offer my views on commissary construction. The long term lease was signed, construction was nearing completion and heavy equipment installations were in progress.

The new commissary opened and the organization is bleeding red on the bottom line. With the commissary draining funds each month, the chance of starting any of the new units is remote. Break even sales volume seems out of reach despite strong growth. So what went wrong? This was a successful single unit operator enjoying better than average unit volume for the region and decent sales growth.

The strategy here is flawed.

Creating the capacity to handle production for 6 units with only one unit operational is suicide. The new monthly fixed costs are too high, production workers spend too much time walking around the mammoth kitchen. Freezers and walkins designed to handle five times the current volume have raised the monthly utility bills. The fleet of vans has increased to handle movement between locations. Sales barely cover the fixed costs and wages.

Rather than wasting the owner's precious time (he works 16 hour days - 7 days a week), I told him he needs to focus on volume rather than food cost control. His sales are too far below break even to worry about incremental food cost improvement.

I'll be working with a different company in the same region. They just opened a new unit in this hot growth area. Sales are double their average unit volume and the operators are feeling the strain. Fortunately, profits and cash flow are robust.

INFORMATION

Phone: (413) 727-8897 email: foodcostwiz@gmail.com

Wednesday, December 20, 2006

Saturday, December 09, 2006

Food Cost Control - Alphabetic Approach

Manufacturing companies often segregate their parts inventories into A, B and C groups. The parts in Group A are used in high volume and are expensive. Group B has two types of parts. The high volume, less costly parts would fall into the B group. Also, expensive parts used in lower volume would be in Group B. Finally, Group C parts would include the largest number of members. These parts are inexpensive and used in low volume.

Why stop with only three letters?

I'd recommend segments for product shelf life and I wouldn't use Group B for two profiles. Let's use Group A to include highly perishable, costly, high volume items. If a costly, high volume item is purchased frozen, we'll use group B. Group C will include all costly, high volume items which are shelf stable.

Following this approach, we'd use groups D, E and F to handle moderate volume items. The perishables would be coded to Group D. Frozen would fit the E profile and the shelf stable would go to Group F.

Since the 80/20 principle is in play in most kitchens, you'll be left with lots of items in groups G, H and I. Use the perishable/frozen/shelf stable structure to complete the grouping exercise.

A 1,000 item inventory will contain about 200 items in the first three groups. The next three groups will have from 150 to 200 items. All the other items will fall into the last three groups. You'll find very few items in Group C vs. Group I. Perhaps coffee and oils will be in the C group and the spices down in Group I.

When you are finished with this exercise, start to spend more time and energy with the first 5 groups. The last four groups will have the majority of items and the least amount of opportunity to favorably impact your food cost percentage.

Click Here For More Information

Why stop with only three letters?

I'd recommend segments for product shelf life and I wouldn't use Group B for two profiles. Let's use Group A to include highly perishable, costly, high volume items. If a costly, high volume item is purchased frozen, we'll use group B. Group C will include all costly, high volume items which are shelf stable.

Following this approach, we'd use groups D, E and F to handle moderate volume items. The perishables would be coded to Group D. Frozen would fit the E profile and the shelf stable would go to Group F.

Since the 80/20 principle is in play in most kitchens, you'll be left with lots of items in groups G, H and I. Use the perishable/frozen/shelf stable structure to complete the grouping exercise.

A 1,000 item inventory will contain about 200 items in the first three groups. The next three groups will have from 150 to 200 items. All the other items will fall into the last three groups. You'll find very few items in Group C vs. Group I. Perhaps coffee and oils will be in the C group and the spices down in Group I.

When you are finished with this exercise, start to spend more time and energy with the first 5 groups. The last four groups will have the majority of items and the least amount of opportunity to favorably impact your food cost percentage.

Click Here For More Information

Monday, November 27, 2006

Constructing The Value Menu

Back in 1992, New York City hosted the Democratic Party Convention. Many of the restaurants offered a special menu for $19.92 to the conventioneers. I worked with several chefs to create profitable menus given the $19.92 constraint. This exercise helped these chefs to continue offering full meal options well after the convention ended.

The best place to begin a value menu is with your most popular entrees. Any menu revision impacts the popular items more than the less popular choices. Rather than taking guests in a different entree direction, allow them to enjoy a more complete meal.

Every operator should know the profile of menu choices per cover. This profile includes the percentage of covers choosing a starter, entree, dessert and coffee course. If you enjoy a large percentage on starters and desserts, you may wish to avoid offering the table d'hote option.

Most table d'hote menu authors include a dessert and coffee course. The dessert options include 2 or 3 low cost items. These items are frequently offered at cost - 100% - to the guest. It's important to properly cost the dessert and coffee course.

The entree course often includes a slightly smaller portion size for the center of the plate choice. Since the diner will have a starter course, the smaller entree portion size will suffice. Try to develop a starter course with a cost equal to the savings on the center of the plate portion.

For example, a well trimmed filet mignon steak may cost $1.00 to $1.50 per ounce. If you reduce the portion from 8 ounces to 6 ounces, you'll have $2.00 to $3.00 with which to create the starter course.

Include the same vegetable, starch and bread courses as the base menu.

To cost the table d'hote meal you'll start with the entree price on the menu. To this number, add the price of the lowest starter course on your menu. Finally, add the cost of the dessert and coffee option (try to keep below $2).

If you charge $25 for the entree and your low cost starter is $5, the table d'hote may be offered for $32. The additional 28% rise in revenue over the entree will produce a very good food cost percentage. The cost of the starter is covered by the decrease in entree size. We have included enough revenue to cover the cost of the dessert and coffee.

You're a winner if the overall check average increases. Track this statistic by day of the week to fine tune the table d'hote strategy.

The best place to begin a value menu is with your most popular entrees. Any menu revision impacts the popular items more than the less popular choices. Rather than taking guests in a different entree direction, allow them to enjoy a more complete meal.

Every operator should know the profile of menu choices per cover. This profile includes the percentage of covers choosing a starter, entree, dessert and coffee course. If you enjoy a large percentage on starters and desserts, you may wish to avoid offering the table d'hote option.

Most table d'hote menu authors include a dessert and coffee course. The dessert options include 2 or 3 low cost items. These items are frequently offered at cost - 100% - to the guest. It's important to properly cost the dessert and coffee course.

The entree course often includes a slightly smaller portion size for the center of the plate choice. Since the diner will have a starter course, the smaller entree portion size will suffice. Try to develop a starter course with a cost equal to the savings on the center of the plate portion.

For example, a well trimmed filet mignon steak may cost $1.00 to $1.50 per ounce. If you reduce the portion from 8 ounces to 6 ounces, you'll have $2.00 to $3.00 with which to create the starter course.

Include the same vegetable, starch and bread courses as the base menu.

To cost the table d'hote meal you'll start with the entree price on the menu. To this number, add the price of the lowest starter course on your menu. Finally, add the cost of the dessert and coffee option (try to keep below $2).

If you charge $25 for the entree and your low cost starter is $5, the table d'hote may be offered for $32. The additional 28% rise in revenue over the entree will produce a very good food cost percentage. The cost of the starter is covered by the decrease in entree size. We have included enough revenue to cover the cost of the dessert and coffee.

You're a winner if the overall check average increases. Track this statistic by day of the week to fine tune the table d'hote strategy.

Monday, November 20, 2006

Value Added Meals

In lieu of cutting menu item prices, many companies decide to bundle several popular menu items into a value meal. When I lived in Montreal, we often ordered the table d'hote option at dinner restaurants. These prix fixe dinners typically included a soup or appetizer, an entree with vegetables, dessert and coffee. If ordered separately, the total price of these menu items would be higher than the house's suggested meal.

Customers may actually spend more money on the table d'hote option. Most people do not order four or five courses during their restaurant visits. By enticing these customers to order a full dinner at the reduced price, the savvy manager may exert an upward pressure on the check average.

If you can change the dynamic and increase customer spending through a perceived value meal, higher revenue and increased cost control may be the result. Prix fixe options are typically limited. Restaurant managers select the table d'hote options carefully each day.

In addition to attracting more dollars from current clientele, new customers may try your restaurant.

The QSR segment offers both value meals and value menus. Value menu boards are loaded with many low cost selections which may be combined to create a meal. Their value meals are constructed around a larger beverage and an extra item (usually fries). Value meals have a set price. The value menu board options may be ordered in any number the customer desires.

I like their value meal strategy far more than the value menu boards. You can work hard to construct attractive and profitable table d'hote meal options. Your check average and food cost will be more predictable and stable.

Customers may actually spend more money on the table d'hote option. Most people do not order four or five courses during their restaurant visits. By enticing these customers to order a full dinner at the reduced price, the savvy manager may exert an upward pressure on the check average.

If you can change the dynamic and increase customer spending through a perceived value meal, higher revenue and increased cost control may be the result. Prix fixe options are typically limited. Restaurant managers select the table d'hote options carefully each day.

In addition to attracting more dollars from current clientele, new customers may try your restaurant.

The QSR segment offers both value meals and value menus. Value menu boards are loaded with many low cost selections which may be combined to create a meal. Their value meals are constructed around a larger beverage and an extra item (usually fries). Value meals have a set price. The value menu board options may be ordered in any number the customer desires.

I like their value meal strategy far more than the value menu boards. You can work hard to construct attractive and profitable table d'hote meal options. Your check average and food cost will be more predictable and stable.

Monday, November 06, 2006

Cost Benefit Analysis

Every business decision has a cost associated with the execution. If the strategy was sound, the benefit derived from the action will exceed the cost incurred executing the tasks. Cost benefit analysis involves the study of results in relationship to the cost of the activity.

The absolute rule (applicable in all cases) is the cost of information may not exceed the expected gain. Any decision which will produce a benefit less than the cost to make the decision, execute the strategy and monitor results is a waste of time. Most decision makers try to filter out the minutiae in order to focus their attention on high impact activities.

As you start any campaign to improve profits through improved food cost control, it is imperative to discover areas which will have the greatest impact for the time and resources required. Try to locate activities which are performed over and over again. Isolate activities which are not consistently performed and activities which have a major impact on the client experience.

A second rule is to avoid destructive cost cutting activities. For example, you may discover the most popular menu item has been chronically over-portioned by the production staff. It would be quite dangerous to dramatically cut the portion size back to the standard in this case. Customers have come to expect the bigger portion and will immediately notice severe reductions. It is wiser to acknowledge the true portion size and develop a less obvious strategy to deal with the issue.

Opportunity cost looks at both missed opportunities and the risks avoided. You have some extra capital to put in play. Do you use it as a down payment on a new location? Would a new advance in POS technology offer a big opportunity? Would an advertising campaign bring more covers to existing locations? These decisions all involve risks and they also involve opportunity costs.

If you do nothing, the money goes into a bank account and earns 2 to 5% interest. This simple activity produces a key decision variable - the risk free value of money. All decisions should be weighed against this risk free return.

Every decision you make needs to be one you are authorized to complete. The organization does not need the wait staff fretting over the selection of a vendor for a new phone system. If you stick to your area of control, you'll have a better chance to make great decisions. If you begin to look at your operation through the CBA lens, you will begin to overlook insignificant issues and focus on real problems and opportunities.

Click Here For More Information

The absolute rule (applicable in all cases) is the cost of information may not exceed the expected gain. Any decision which will produce a benefit less than the cost to make the decision, execute the strategy and monitor results is a waste of time. Most decision makers try to filter out the minutiae in order to focus their attention on high impact activities.

As you start any campaign to improve profits through improved food cost control, it is imperative to discover areas which will have the greatest impact for the time and resources required. Try to locate activities which are performed over and over again. Isolate activities which are not consistently performed and activities which have a major impact on the client experience.

A second rule is to avoid destructive cost cutting activities. For example, you may discover the most popular menu item has been chronically over-portioned by the production staff. It would be quite dangerous to dramatically cut the portion size back to the standard in this case. Customers have come to expect the bigger portion and will immediately notice severe reductions. It is wiser to acknowledge the true portion size and develop a less obvious strategy to deal with the issue.

Opportunity cost looks at both missed opportunities and the risks avoided. You have some extra capital to put in play. Do you use it as a down payment on a new location? Would a new advance in POS technology offer a big opportunity? Would an advertising campaign bring more covers to existing locations? These decisions all involve risks and they also involve opportunity costs.

If you do nothing, the money goes into a bank account and earns 2 to 5% interest. This simple activity produces a key decision variable - the risk free value of money. All decisions should be weighed against this risk free return.

Every decision you make needs to be one you are authorized to complete. The organization does not need the wait staff fretting over the selection of a vendor for a new phone system. If you stick to your area of control, you'll have a better chance to make great decisions. If you begin to look at your operation through the CBA lens, you will begin to overlook insignificant issues and focus on real problems and opportunities.

Click Here For More Information

Thursday, October 26, 2006

We Don't Know Our Costs

My boss at Sodexho always said "We don't know our costs." whenever the food cost percentage was too high. Generally, the remote site feeding business should be very predictable. Patrons live onsite and have zero options outside the dining room at the camp. If a room is occupied for a night, we'd expect the resident to show for breakfast, lunch and dinner. Straight forward revenue calculation involves the number of people in camp multiplied by the rate per person per day.

Problems in this business segment occur at mature projects after contract renewal. Since the competition is fierce, operators look for every possible advantage. When responding to the RFP, the bidders try to gain a cost advantage over their competitors.

If the camp is close to a urban area (close would typically mean a short flight), many of the residents leave on the weekend. Playing the game involves predicting the probability the Friday evening meal will NOT be attended. In addition, Sunday dinner attendees provide a full manday of revenue. Even weekend travelers provide an operator with revenue if they eat Sunday dinner (though no bed was made and breakfast and lunch were not consumed). Sounds like a bonus for the caterer.

Many times, the initial bid prices have this favorable activity built into the price matrix. Now the bonus turns into a risky game. Bad weather, overtime pay opportunities and special events may keep residents onsite over the weekend even though the prices reflect more checkouts.

Some of the best operators provide a fantastic Sunday night meal and advertise the menu during the week. All efforts are focused on a big turnout. When the residents do not leave as expected, Sunday costs per manday can be very high.

A few years ago, Darden's stock went lower due to a major turnout at their all-you-can-eat seafood buffets. Higher patron counts actually hurt their bottom line.

I have found many of my clients pushing menu items with ideal food cost percentages over 50% (some over 100%). It's tough to make a decent profit when you're not charging enough for your popular menu items. When my clients were wrong on the low side, they tended to be wrong on the most popular items. Savvy patrons recognize a value and order these lost leaders more frequently. Do you know your costs?

Problems in this business segment occur at mature projects after contract renewal. Since the competition is fierce, operators look for every possible advantage. When responding to the RFP, the bidders try to gain a cost advantage over their competitors.

If the camp is close to a urban area (close would typically mean a short flight), many of the residents leave on the weekend. Playing the game involves predicting the probability the Friday evening meal will NOT be attended. In addition, Sunday dinner attendees provide a full manday of revenue. Even weekend travelers provide an operator with revenue if they eat Sunday dinner (though no bed was made and breakfast and lunch were not consumed). Sounds like a bonus for the caterer.

Many times, the initial bid prices have this favorable activity built into the price matrix. Now the bonus turns into a risky game. Bad weather, overtime pay opportunities and special events may keep residents onsite over the weekend even though the prices reflect more checkouts.

Some of the best operators provide a fantastic Sunday night meal and advertise the menu during the week. All efforts are focused on a big turnout. When the residents do not leave as expected, Sunday costs per manday can be very high.

A few years ago, Darden's stock went lower due to a major turnout at their all-you-can-eat seafood buffets. Higher patron counts actually hurt their bottom line.

I have found many of my clients pushing menu items with ideal food cost percentages over 50% (some over 100%). It's tough to make a decent profit when you're not charging enough for your popular menu items. When my clients were wrong on the low side, they tended to be wrong on the most popular items. Savvy patrons recognize a value and order these lost leaders more frequently. Do you know your costs?

Tuesday, October 17, 2006

Selective Menu Revision

If the higher fuel prices and dropping home values are cutting your covers, you may still see full dining rooms on the traditional busy nights. Keeping the menu intact will allow a baseline business volume to be established each week. Try to use the revenue from these nights to cover all fixed expenses.

Cut fixed costs to the bone.

On the slower nights, use cost-volume-profit models to determine special prices. If your fixed costs are already covered, you could afford to offer free appetizers, two-for-one entree deals, a free glass of wine, prix-fixe menus, etc. (early in the week). You absolutely need to understand and cover any variable costs.

If you know your key cost components through standard recipes and tight flex schedules, it's easier to target your lost leaders. For example, don't choose labor intensive entrees for the two-for-one specials. Any specials should use ingredients with stable pricing which fit your menu. Avoid menu specials which require long prep times and precise forecasts (e.g. prime rib or other slow cooked roasts).

You could offer busy night customers an incentive to return during the slower nights. Special offers could be included with the check.

When I travel in the evening, I often swing by client operations on my way to the hotel. Many times I see employees at the bar late in the night consuming drinks and food. Zero patrons in the dining room should signal it's time to close the door. Cutting dining room hours on slow nights is a win-win solution. Service employees avoid longer hours for little pay, the kitchen staff gets extra rest and management saves the added labor and overhead expenses.

In summary, stable menu prices will allow you to cover overhead costs with your busy night customers. Slow night tactics (discounts, flexible cost strategies and selective incentives) will put profits in the bank.

Cut fixed costs to the bone.

On the slower nights, use cost-volume-profit models to determine special prices. If your fixed costs are already covered, you could afford to offer free appetizers, two-for-one entree deals, a free glass of wine, prix-fixe menus, etc. (early in the week). You absolutely need to understand and cover any variable costs.

If you know your key cost components through standard recipes and tight flex schedules, it's easier to target your lost leaders. For example, don't choose labor intensive entrees for the two-for-one specials. Any specials should use ingredients with stable pricing which fit your menu. Avoid menu specials which require long prep times and precise forecasts (e.g. prime rib or other slow cooked roasts).

You could offer busy night customers an incentive to return during the slower nights. Special offers could be included with the check.

When I travel in the evening, I often swing by client operations on my way to the hotel. Many times I see employees at the bar late in the night consuming drinks and food. Zero patrons in the dining room should signal it's time to close the door. Cutting dining room hours on slow nights is a win-win solution. Service employees avoid longer hours for little pay, the kitchen staff gets extra rest and management saves the added labor and overhead expenses.

In summary, stable menu prices will allow you to cover overhead costs with your busy night customers. Slow night tactics (discounts, flexible cost strategies and selective incentives) will put profits in the bank.

Thursday, October 05, 2006

Avoid Slashing Your Menu Prices

Economic conditions are rapidly changing with worldwide demand for energy at an all time high and rising interest rates in the USA. Higher costs are functioning as a tax on discretionary income. Borrowers and drivers are paying a lot more for money and gas. Restaurant expenditures often depend on patron's discretionary income. With the home equity line of credit option disappearing rapidly, credit card expenditures will be tightly monitored by more consumers.

Recently, I went for a walk on a Wednesday evening at 8 PM in my neighborhood. I passed by 4 restaurants and dining rooms had lots of available tables. The best of the four was a popular chain steak house concept. Let's try to put ourselves in the shoes of management.

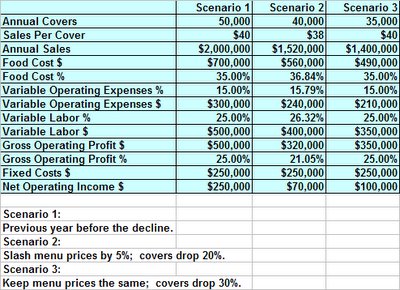

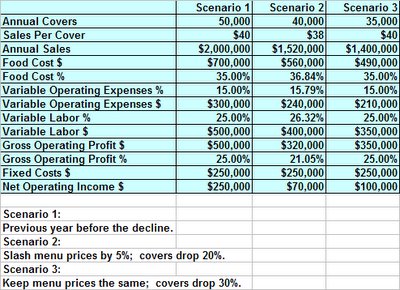

Last year, our example steak house had annual covers of 50,000 and sales of $2,000,000. Covers in the current month are off 30% vs. the same month last year. The current average sales per cover is $40 and management is studying options.

One manager favors a 5% across the board cut in menu prices. The hope is to keep the drop in covers at 20% vs. last year. Sales would drop to $1,520,000 and the food cost % would increase 1.84% (to 36.84% up from 35%). Labor expenses and other operating expenses are forecasted to hold at the current cost per cover.

The general manager sees danger in the drop and favors holding menu prices at the current levels.

So who has the better plan?

Across the board menu price cuts are always risky. As covers decline, we would also see a drop in the contribution per cover. This is a very difficult plan to manage.

I prefer the GM's solution. No menu reprint is required and there are plenty of tactical options available. Selective price drops may be implemented using specials to promote entrees using lower cost seasonal ingredients. Specific days of the week could be targeted for selective price cuts. As long as the covers on busy nights and busy seasons stay close to plan, the strategy will succeed.

In our example, the GM's solution would produce a higher profit despite a steeper drop in covers. A 5% cut in sales per cover would not produce a bigger profit despite 5,000 more covers. The drop in sales per cover of $2 is not a simple to implement strategy. All income statement accounts would feel the impact. Waitstaff would see their tips per cover decline. Careful study is needed to predict the impact on your operation.

Recently, I went for a walk on a Wednesday evening at 8 PM in my neighborhood. I passed by 4 restaurants and dining rooms had lots of available tables. The best of the four was a popular chain steak house concept. Let's try to put ourselves in the shoes of management.

Last year, our example steak house had annual covers of 50,000 and sales of $2,000,000. Covers in the current month are off 30% vs. the same month last year. The current average sales per cover is $40 and management is studying options.

One manager favors a 5% across the board cut in menu prices. The hope is to keep the drop in covers at 20% vs. last year. Sales would drop to $1,520,000 and the food cost % would increase 1.84% (to 36.84% up from 35%). Labor expenses and other operating expenses are forecasted to hold at the current cost per cover.

The general manager sees danger in the drop and favors holding menu prices at the current levels.

So who has the better plan?

Across the board menu price cuts are always risky. As covers decline, we would also see a drop in the contribution per cover. This is a very difficult plan to manage.

I prefer the GM's solution. No menu reprint is required and there are plenty of tactical options available. Selective price drops may be implemented using specials to promote entrees using lower cost seasonal ingredients. Specific days of the week could be targeted for selective price cuts. As long as the covers on busy nights and busy seasons stay close to plan, the strategy will succeed.

In our example, the GM's solution would produce a higher profit despite a steeper drop in covers. A 5% cut in sales per cover would not produce a bigger profit despite 5,000 more covers. The drop in sales per cover of $2 is not a simple to implement strategy. All income statement accounts would feel the impact. Waitstaff would see their tips per cover decline. Careful study is needed to predict the impact on your operation.

Monday, September 25, 2006

High Degree of Operating Leverage

Some of my earliest clients were high volume restaurants on the New Jersey Shore. I noticed some key similarities among the successful operators. The very best started with a small operation on a relatively large area of land. Over time, they grew the restaurant's capacity with incremental additions. At their peak, these restaurants had many dining rooms and multiple kitchens. Some were found in the annual top 100 lists in industry publications.

As I gained clients further north in the state, I advised them to try growing incrementally and talked some out of major unit expansion. Rather than enlarging the fixed cost base, I advised them to maximize their profit at existing locations.

Since food service operations exist in a highly competitive environment, operating margins tend to be low. A restaurant operating at or near their break-even point will have a high degree of operating leverage. Any increase in sales volume beyond break-even will produce a significant increase in the bottom line. This leverage will decline as sales volumes increase over time.

To illustrate the concept of degree of operating leverage, let's look at an example of a steak house concept doing 50,000 covers per year and an average sales per cover of $40. Their 35% food cost translates to $14 per cover, their variable labor is $10 per cover and direct operating expenses are $6 per cover. Fixed costs total $250,000. The degree of operating leverage at this point in time will equal 2. A 25% increase in sales will produce a 50% increase in profits.

Rather than opening a new unit 20 miles away, the operators convert unused floor space into an additional dining room. The new seats fill quickly on busy nights and the room is closed early in the week. Covers increase by 25% to 62,500. If all costs remain in line, profit will expand by 50% from $250,000 to $375,000.

One of my clients expanded the dining area in the original restaurant three times before successfully opening a second location. The steady cash flow from the original site allowed him to take a bold move and he now has two high volume operations.

As I gained clients further north in the state, I advised them to try growing incrementally and talked some out of major unit expansion. Rather than enlarging the fixed cost base, I advised them to maximize their profit at existing locations.

Since food service operations exist in a highly competitive environment, operating margins tend to be low. A restaurant operating at or near their break-even point will have a high degree of operating leverage. Any increase in sales volume beyond break-even will produce a significant increase in the bottom line. This leverage will decline as sales volumes increase over time.

To illustrate the concept of degree of operating leverage, let's look at an example of a steak house concept doing 50,000 covers per year and an average sales per cover of $40. Their 35% food cost translates to $14 per cover, their variable labor is $10 per cover and direct operating expenses are $6 per cover. Fixed costs total $250,000. The degree of operating leverage at this point in time will equal 2. A 25% increase in sales will produce a 50% increase in profits.

Rather than opening a new unit 20 miles away, the operators convert unused floor space into an additional dining room. The new seats fill quickly on busy nights and the room is closed early in the week. Covers increase by 25% to 62,500. If all costs remain in line, profit will expand by 50% from $250,000 to $375,000.

One of my clients expanded the dining area in the original restaurant three times before successfully opening a second location. The steady cash flow from the original site allowed him to take a bold move and he now has two high volume operations.

Wednesday, September 20, 2006

Entree Pricing-Dollars vs. Percentages

The adage says "We put dollars in the bank NOT percentages." So, should you run some higher priced entrees with a corresponding higher food cost percentage to boost profits? Maybe. You should be prepared for some unplanned possibilities.

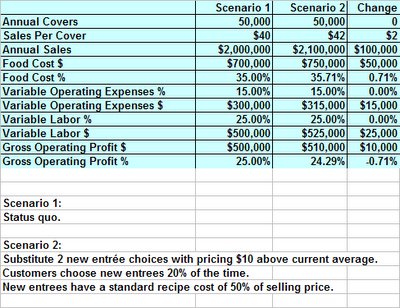

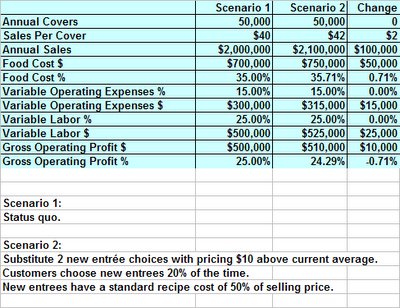

I'm going to use an example steak house with current annual covers of 50,000 and sales of $2,000,000. The average sales per cover is $40. Management has decided to introduce two new entrees priced $10 above the current average entree price. These entrees are costlier and will raise the food cost percentage.

Let's say 20% of patrons choose the new entrees and covers remain stable. Sales increase $100,000 and food costs go up $50,000. We should have another $50,000 going in the bank account. It's a good thing...right? Maybe.

All too often, managers forget to follow through with the dollars vs. percentages concept in the other cost components. If they track labor cost and other operating expenses on a percentage basis, a big chunk of the $50,000 could leave the bank even though operating reports look solid (percentage viewpoint). These cost components are fairly difficult to manage on an entree basis. Few companies track utilities on a per cover basis.

If we had variable labor costs of 25% and other operating expenses of 15%, you could see $40,000 (40% of $100,000) in higher labor and operating expenses creep into the income statement over time. We'd still be $10,000 ahead of the status quo.

If the raw ingredients used to prepare the pricier entrees are more volatile in price, you could actually see months with zero change in the bottom line despite a nice sales jump. How often do you read articles about publicly traded restaurant companies with higher check averages and average unit volumes with little to show on the bottom line? Management explains the disappointing profits are due to higher prices for key entree items. It happens all the time.

I'm all for more dollars in the bank. Don't ignore percentages when implementing these strategies.

I'm going to use an example steak house with current annual covers of 50,000 and sales of $2,000,000. The average sales per cover is $40. Management has decided to introduce two new entrees priced $10 above the current average entree price. These entrees are costlier and will raise the food cost percentage.

Let's say 20% of patrons choose the new entrees and covers remain stable. Sales increase $100,000 and food costs go up $50,000. We should have another $50,000 going in the bank account. It's a good thing...right? Maybe.

All too often, managers forget to follow through with the dollars vs. percentages concept in the other cost components. If they track labor cost and other operating expenses on a percentage basis, a big chunk of the $50,000 could leave the bank even though operating reports look solid (percentage viewpoint). These cost components are fairly difficult to manage on an entree basis. Few companies track utilities on a per cover basis.

If we had variable labor costs of 25% and other operating expenses of 15%, you could see $40,000 (40% of $100,000) in higher labor and operating expenses creep into the income statement over time. We'd still be $10,000 ahead of the status quo.

If the raw ingredients used to prepare the pricier entrees are more volatile in price, you could actually see months with zero change in the bottom line despite a nice sales jump. How often do you read articles about publicly traded restaurant companies with higher check averages and average unit volumes with little to show on the bottom line? Management explains the disappointing profits are due to higher prices for key entree items. It happens all the time.

I'm all for more dollars in the bank. Don't ignore percentages when implementing these strategies.

Thursday, September 14, 2006

Ideal Usage Tricks and Techniques

The people who produce variance reports for the weekly and monthly management meetings need to forecast the likely meeting discussion for each red flag item. Common excuses occur over and over and it's necessary to anticipate and eliminate these distractions. The only way for a food and beverage professional to have a positive impact on the results is through proper focus.

Find the real problems ahead of time and structure your handouts (or overhead presentation)to highlight the major issues. Everything else is simply an exercise in excusing poor results. When the acceptance of these anecdotal responses is chronic, the operation will lose control and wide fluctuations in monthly numbers will ensue. Hopefully, a review of the common excuses will help you prepare for the next meeting and the tide will turn.

At the very top of my list is the inaccurate inventory extension. Since you should have complete control over this number, avoid making bad numbers "the reason" and take the extra time to double check all very small and very large extended values. There shouldn't be any spice, flour, pasta or rice valued in the thousands of dollars. Lobster tails shouldn't be valued for pennies. Make a second copy of your Excel file and sort the list in both ascending and descending order. See what comes to the top and ask if it makes sense.

Cutoff issues are always near the top of the list and the actual inventory count should be taken without deliveries. Check your drawers thoroughly and look under the desk for missing invoices. If you keep a receiving log (highly recommended), use the log to make sure you have every delivery included in the proper accounting period. Check with accounts payable for a copy of the latest statement and see if the credits are reported in the proper period. Try to completely eliminate accounting adjustments from the management meeting discussions. It is a distraction and credibility quickly disappears when the numbers don't follow the matching principle.

The operators will have front line experiences which should be the real focus of the meeting and it's important to be prepared to support these topics. Let's say you have a major unfavorable usage number for beef tenderloin. Do your own investigation on customer returns and possible menu specials(POS system data). Check waste reports if you maintain these records. Subtract the waste from the total variance to determine the net amount (variance NOT explained by waste). Try to get to the heart of the variance. There will always be steaks returned by customers due to miscommunication of their cooking preference. Excessive waste and customer returns must be documented and the problems must be solved fast.

Production staff will give better explanations if the topic is presented in a straight forward manner. Imagine the meeting dynamics. It's possible for certain issues to be assigned too much weight. If the waste and returns are minor, report the total variance and show a separate line for the waste and returns. Calculate the net variance and open the discussion with this figure. You may find the real problem involves meat which did not meet specification. Portion control may be lax. There is always a risk of theft. Listen for other explanations and you'll get closer to the true variance issue.

Before your meetings, go back to your recipe model and look for recipes which call the top variance items. Follow the recipe path backwards if there is butchering or trimming involved. Ask yourself if the actual usage is a better figure than the ideal usage. My tenderloin example was chosen specifically for this angle. An untrimmed tenderloin will lose close to 50% of it's weight when being prepared for steaks. If you don't have a butcher yield sheet for the item, print one for the meeting and make it an action plan item.

Once you are in the meeting, get the variance analysis focused by introducing each item thoroughly before the discussion begins. Your credibility will increase as you move beyond traditional distractions involving inaccurate extensions and cutoff problems. Supply everyone with your preliminary analysis and highlight the net variance. As the management team begins to take you seriously, they will come better prepared and some genuine progress will be the result.

Find the real problems ahead of time and structure your handouts (or overhead presentation)to highlight the major issues. Everything else is simply an exercise in excusing poor results. When the acceptance of these anecdotal responses is chronic, the operation will lose control and wide fluctuations in monthly numbers will ensue. Hopefully, a review of the common excuses will help you prepare for the next meeting and the tide will turn.

At the very top of my list is the inaccurate inventory extension. Since you should have complete control over this number, avoid making bad numbers "the reason" and take the extra time to double check all very small and very large extended values. There shouldn't be any spice, flour, pasta or rice valued in the thousands of dollars. Lobster tails shouldn't be valued for pennies. Make a second copy of your Excel file and sort the list in both ascending and descending order. See what comes to the top and ask if it makes sense.

Cutoff issues are always near the top of the list and the actual inventory count should be taken without deliveries. Check your drawers thoroughly and look under the desk for missing invoices. If you keep a receiving log (highly recommended), use the log to make sure you have every delivery included in the proper accounting period. Check with accounts payable for a copy of the latest statement and see if the credits are reported in the proper period. Try to completely eliminate accounting adjustments from the management meeting discussions. It is a distraction and credibility quickly disappears when the numbers don't follow the matching principle.

The operators will have front line experiences which should be the real focus of the meeting and it's important to be prepared to support these topics. Let's say you have a major unfavorable usage number for beef tenderloin. Do your own investigation on customer returns and possible menu specials(POS system data). Check waste reports if you maintain these records. Subtract the waste from the total variance to determine the net amount (variance NOT explained by waste). Try to get to the heart of the variance. There will always be steaks returned by customers due to miscommunication of their cooking preference. Excessive waste and customer returns must be documented and the problems must be solved fast.

Production staff will give better explanations if the topic is presented in a straight forward manner. Imagine the meeting dynamics. It's possible for certain issues to be assigned too much weight. If the waste and returns are minor, report the total variance and show a separate line for the waste and returns. Calculate the net variance and open the discussion with this figure. You may find the real problem involves meat which did not meet specification. Portion control may be lax. There is always a risk of theft. Listen for other explanations and you'll get closer to the true variance issue.

Before your meetings, go back to your recipe model and look for recipes which call the top variance items. Follow the recipe path backwards if there is butchering or trimming involved. Ask yourself if the actual usage is a better figure than the ideal usage. My tenderloin example was chosen specifically for this angle. An untrimmed tenderloin will lose close to 50% of it's weight when being prepared for steaks. If you don't have a butcher yield sheet for the item, print one for the meeting and make it an action plan item.

Once you are in the meeting, get the variance analysis focused by introducing each item thoroughly before the discussion begins. Your credibility will increase as you move beyond traditional distractions involving inaccurate extensions and cutoff problems. Supply everyone with your preliminary analysis and highlight the net variance. As the management team begins to take you seriously, they will come better prepared and some genuine progress will be the result.

Thursday, September 07, 2006

Food Storage Rules

There are certain items which must be stored more carefully in order to hit your cost targets. Highly perishable items are the top priority. With most vendors running daily deliveries (despite rising gas prices), the quantity of highly perishable goods should be minimized. Schedule the purchases carefully and avoid excessive buys. Spoilage of highly perishable items should be kept to an absolute minimum. Make sure the coolers are well organized and always rotate stock after a delivery.

Store items with a high risk of theft in very visible locations. Too often, I see small, high cost portions of premium meats and seafood left in storage areas far from management's view. Certain operations stock 5 ounce tenderloin portions and jumbo shrimp in storage areas well away from the office. It's much better to move these items close to your field of vision.

If you like video surveillance systems, make sure one of the cameras is pointed at the location used to store high risk items. If you use pull sheets, keep the sheets for these coolers in your office and in plain view. You should know how many portions are available for sale to customers at the start of each shift. On a rotation basis, you should subtract the meal period POS menu item counts from the opening quantity and check the inventory. At a minimum, count these high risk items daily.

Make your freezers easy to count. Keep everything in the exact same location at all times. Messy freezers are a problem which should be solved ASAP. If items are improperly stored in the frigid environment, it's very likely you will order more when they are in stock. Once the staff see the new delivery, theft is easier and unlikely to be detected.

Walkin coolers should follow the same rules as the freezer. If you need some space for rotation of special items, try to set aside a separate cooler or a defined section of your larger cooler. Most items should be stored in the exact same location at all times. Orderly freezers and coolers make ordering more efficient and help prevent unwanted losses due to theft and spoilage.

Finally, dry storage areas are typically the best maintained of all inventory locations. Make sure super expensive items like saffron and truffle oil is in a place where theft is completely impossible. Keep the storage rooms dry and cool and watch expiration dates. Try to reorder dry items using a par stock system. Determining par levels may be difficult for event caterers but most operations should find two or three par levels sufficient. For busy periods, build the stock to the high par level. Drop the par when business is slow. Maintain the status quo at other times.

Click Here For More Information

Store items with a high risk of theft in very visible locations. Too often, I see small, high cost portions of premium meats and seafood left in storage areas far from management's view. Certain operations stock 5 ounce tenderloin portions and jumbo shrimp in storage areas well away from the office. It's much better to move these items close to your field of vision.

If you like video surveillance systems, make sure one of the cameras is pointed at the location used to store high risk items. If you use pull sheets, keep the sheets for these coolers in your office and in plain view. You should know how many portions are available for sale to customers at the start of each shift. On a rotation basis, you should subtract the meal period POS menu item counts from the opening quantity and check the inventory. At a minimum, count these high risk items daily.

Make your freezers easy to count. Keep everything in the exact same location at all times. Messy freezers are a problem which should be solved ASAP. If items are improperly stored in the frigid environment, it's very likely you will order more when they are in stock. Once the staff see the new delivery, theft is easier and unlikely to be detected.

Walkin coolers should follow the same rules as the freezer. If you need some space for rotation of special items, try to set aside a separate cooler or a defined section of your larger cooler. Most items should be stored in the exact same location at all times. Orderly freezers and coolers make ordering more efficient and help prevent unwanted losses due to theft and spoilage.

Finally, dry storage areas are typically the best maintained of all inventory locations. Make sure super expensive items like saffron and truffle oil is in a place where theft is completely impossible. Keep the storage rooms dry and cool and watch expiration dates. Try to reorder dry items using a par stock system. Determining par levels may be difficult for event caterers but most operations should find two or three par levels sufficient. For busy periods, build the stock to the high par level. Drop the par when business is slow. Maintain the status quo at other times.

Click Here For More Information

Tuesday, August 29, 2006

Leave Labor Out Of Inventory

From time to time, my clients ask about the practice of including labor expenses in work in process inventory valuation. I am against this practice due to needless complexity. Those who decide to change their inventory policy always see a one period bump. However, in the long run, the impact of this policy change will be low.

The key issue in the decision is the perishable nature of food (both as purchased and prepped). Most food inventories run about 14 days of cost of sales or less. Within the total inventory value, at least 75% is typically stored as purchased. One fourth (about one half week) may be in the prep box. Adding another 20% to the value of the WIP items to account for labor cost will reduce cost of goods sold about 2.5% in month one (see calculation below).

Once you hit month two, the inventory change will be minimal. Now you have locked yourself into a needless monthly exercise. It is far more conservative to completely expense all labor in the month the hours were spent. Even seasonal operations should see very little benefit with adding labor to WIP.

The key to inventory valuation in our industry is proper tracking yields on the work in process items. A steak should be valued at a greater price per pound than the large cut of meat butchered to produce the steak. Divide the as purchased price per pound by the yield percentage. Go the extra step of adding a separate line item on your inventory sheets. Let the counters weigh the large untouched cuts and keep a separate count of the trimmed portions.

If you carefully track the entire butchering and prep process for yields, you will create enough data to properly determine standards for ideal usage calculations. Many operators fail to evaluate a large enough data set when creating these standards. Comparing week to week variances from solid standard yields will explain most of the differences in your food cost. Theft and spoilage is far more difficult to quantify. Employees rarely document waste and theft each period.

Calculation: (3.5 divided by 28) times 20% equals 2.5%.

Click Here For More Information

The key issue in the decision is the perishable nature of food (both as purchased and prepped). Most food inventories run about 14 days of cost of sales or less. Within the total inventory value, at least 75% is typically stored as purchased. One fourth (about one half week) may be in the prep box. Adding another 20% to the value of the WIP items to account for labor cost will reduce cost of goods sold about 2.5% in month one (see calculation below).

Once you hit month two, the inventory change will be minimal. Now you have locked yourself into a needless monthly exercise. It is far more conservative to completely expense all labor in the month the hours were spent. Even seasonal operations should see very little benefit with adding labor to WIP.

The key to inventory valuation in our industry is proper tracking yields on the work in process items. A steak should be valued at a greater price per pound than the large cut of meat butchered to produce the steak. Divide the as purchased price per pound by the yield percentage. Go the extra step of adding a separate line item on your inventory sheets. Let the counters weigh the large untouched cuts and keep a separate count of the trimmed portions.

If you carefully track the entire butchering and prep process for yields, you will create enough data to properly determine standards for ideal usage calculations. Many operators fail to evaluate a large enough data set when creating these standards. Comparing week to week variances from solid standard yields will explain most of the differences in your food cost. Theft and spoilage is far more difficult to quantify. Employees rarely document waste and theft each period.

Calculation: (3.5 divided by 28) times 20% equals 2.5%.

Click Here For More Information

Wednesday, August 16, 2006

Navigating Through The Recipe Jungle

From time to time, certain issues surface when recipe standards are effected by seasonal shifts. The common high impact issue concerns produce yield and price as seasons change. For example, the Romaine lettuce you purchase in the off season may not only cost more. The yield will be far less than peak season. Often you will see a case price double and the yield decline.

These times of high priced, low yield purchases should trigger a menu shift. In winter, I'd recommend as the special each night a wonderful soup made from seasonal root vegetables. Steer the customers away from the popular Caesar Salad to Minestrone.

At this time, we in the Northeastern USA will see prices plummet on beautiful peppers. Menu items with roasted peppers, stuffed peppers and sauteed peppers will fully utilize the high yield, low price cases. On the other hand, this may be the absolute worst time of year to buy apples. With a few weeks to go until the apple harvest begins, current offerings are often of poor quality and from 50% to 70% above prices you can expect to pay in one month.

If your menu is inflexible and some highly popular items must be produced from ingredients which are out of season, create a completely new recipe calling the

poor yield item at the inflated price. Save your main recipe for the peak season.

Now when your food cost percentage trends upward, you'll be able to quantify the impact of the limitation in your menu.

Click Here For More Information

These times of high priced, low yield purchases should trigger a menu shift. In winter, I'd recommend as the special each night a wonderful soup made from seasonal root vegetables. Steer the customers away from the popular Caesar Salad to Minestrone.

At this time, we in the Northeastern USA will see prices plummet on beautiful peppers. Menu items with roasted peppers, stuffed peppers and sauteed peppers will fully utilize the high yield, low price cases. On the other hand, this may be the absolute worst time of year to buy apples. With a few weeks to go until the apple harvest begins, current offerings are often of poor quality and from 50% to 70% above prices you can expect to pay in one month.

If your menu is inflexible and some highly popular items must be produced from ingredients which are out of season, create a completely new recipe calling the

poor yield item at the inflated price. Save your main recipe for the peak season.

Now when your food cost percentage trends upward, you'll be able to quantify the impact of the limitation in your menu.

Click Here For More Information

Saturday, August 12, 2006

The Recipes Are Wrong!

Variance reports frequently identify huge differences between actual item usage and the calculated ideal usage. There are many reasons for these major red flags. To eliminate the obvious, you need to review the fundamental calculation of actual usage. Recheck your counts from the two inventories. Go over the invoices for the period. Check for very small and very large quantities. Make sure you did not miss an entire invoice. Pay strict attention to invoices near a cutoff date. Anything received after the ending inventory should be excluded.

Once you have adjusted your actual usage to reflect changes, take a second look at the variance. You need to switch your focus to the recipe model. If an item is butchered, trimmed, cleaned, processed or if the item increases in volume when cooked (e.g. rice, pasta, etc.), you need to check your standard yields. Make sure you haven't entered the reciprocal figure in a subrecipe yield.

The final check is in plate recipes and portion sizes. These quantities should be exact and at this phase allowances for tiny variation should be avoided. Your plate recipe model should not be soft. You need exact portion sizes to tie to POS counts.

Whenever possible, line cooks should use pre-portioned items in the final production.

If you finish your review and find the inventories were accurate, purchases were all in order and the recipe model is accurate, you have an operational problem. There are certain problems which persist in our industry.

Employee consumption of food and beverage items has a bigger impact in slow periods. During the off-season or slow days of the week, employee meal cost will be higher as a percentage of sales. Adjust your expectations to this reality and move on to much greater concerns.

Collusion with vendor delivery staff is the first possible problem. You need to only pay for food actually received. Make sure receiving controls are rock solid. Limit your testing to invoices with large variance items. Problems may occur on certain shifts or on a specific day of the week. Check each invoice for the delivery person and your receiving person. Look for patterns.

Chronic, unintentional food overuse needs to be identified and halted. Training will correct future overuse. Portions of salads, starches (including french fries), garnishes, soups, sauces and all other discretionary prep items need to be clear. If the operation uses forecasts to prepare for a busy period and perishable items need to be discarded, fill out waste sheets and record the reason as bad forecast.

Your storage areas should be easy to count and high cost items should be difficult to steal. Small portions of tenderloin, shrimp, lobster tails and crab may require additional controls. Pull sheets are helpful. Sheets should be completed with initials and checked by the manager each shift change.

Late night and early morning are the times of greatest probability of theft. Delivery times are just as bad as the close. If you have surveillance systems in place, these periods should be highly scrutinized. We have found brazen thieves taking full cases of food to the dumpsters, trunks of their car, etc. It's best to terminate these people at once.

When I first started my consulting practice, there were two excellent articles on theft. The Wall Street Journal had a survey conducted by F.W. Dodge in which they interviewed food service employees. Of the respondents, 44% admitted to theft. I went to see if there was any other sources on employee theft. I found a general psychology article (source unknown) which stated about 20% of workers are very honest and 20% of workers are very dishonest. The middle 60% tend to follow the herd. If they are working with a completely honest person, theft is minimal. However, when they work with thieves, they will often steal to the same extent as their dishonest co-worker.

Over the years, I have seen major mistakes made by honest workers. One person left spare ribs unattended on a grill to check a delivery and they were inedible. Another person decided to pre-cook a huge number of rotisserie chickens for a special promotion on a low traffic day. In both cases, the employees made mistakes which were one time events. Both of my clients said nothing to the employees. They both realized their mistakes and brought them to management's attention in the first place. Keeping records on simple waste sheets encourages this honest loss activity to be quantified and archived for future period comparisons.

It's difficult for me to leave the theft issue hanging and management often can't see how major theft is possible. However, over the years we have found managers with relatives in the pizza business filling a van with flour, cheese and canned tomatoes. A multi-unit chain in New York tracked a vendor delivery person who visited five of their stores trying to sell cases of shrimp as a "cash only" special. Someone lost the shrimp due to poor receiving controls. My first consulting client ever couldn't believe the long time chef was a thief until the employee admitted he stole two blocks of 16-20 shrimp a week.

If you believe you have reviewed and corrected all the items mentioned above and your variances still don't make sense. Review the POS setup for all menu items which call for the variance item. Look for specials, the OPEN FOOD key and buffets. You may even find the item is wrong in the system. Some companies allow managers to overwrite the menu item names on the POS. I'm not a fan of this method. The entire history is ruined with one small change.

If the operation has no issues at all, check the recipe. Maybe it really isn't correct. Sometimes the wizards make mistakes.

Once you have adjusted your actual usage to reflect changes, take a second look at the variance. You need to switch your focus to the recipe model. If an item is butchered, trimmed, cleaned, processed or if the item increases in volume when cooked (e.g. rice, pasta, etc.), you need to check your standard yields. Make sure you haven't entered the reciprocal figure in a subrecipe yield.

The final check is in plate recipes and portion sizes. These quantities should be exact and at this phase allowances for tiny variation should be avoided. Your plate recipe model should not be soft. You need exact portion sizes to tie to POS counts.

Whenever possible, line cooks should use pre-portioned items in the final production.

If you finish your review and find the inventories were accurate, purchases were all in order and the recipe model is accurate, you have an operational problem. There are certain problems which persist in our industry.

Employee consumption of food and beverage items has a bigger impact in slow periods. During the off-season or slow days of the week, employee meal cost will be higher as a percentage of sales. Adjust your expectations to this reality and move on to much greater concerns.

Collusion with vendor delivery staff is the first possible problem. You need to only pay for food actually received. Make sure receiving controls are rock solid. Limit your testing to invoices with large variance items. Problems may occur on certain shifts or on a specific day of the week. Check each invoice for the delivery person and your receiving person. Look for patterns.

Chronic, unintentional food overuse needs to be identified and halted. Training will correct future overuse. Portions of salads, starches (including french fries), garnishes, soups, sauces and all other discretionary prep items need to be clear. If the operation uses forecasts to prepare for a busy period and perishable items need to be discarded, fill out waste sheets and record the reason as bad forecast.

Your storage areas should be easy to count and high cost items should be difficult to steal. Small portions of tenderloin, shrimp, lobster tails and crab may require additional controls. Pull sheets are helpful. Sheets should be completed with initials and checked by the manager each shift change.

Late night and early morning are the times of greatest probability of theft. Delivery times are just as bad as the close. If you have surveillance systems in place, these periods should be highly scrutinized. We have found brazen thieves taking full cases of food to the dumpsters, trunks of their car, etc. It's best to terminate these people at once.

When I first started my consulting practice, there were two excellent articles on theft. The Wall Street Journal had a survey conducted by F.W. Dodge in which they interviewed food service employees. Of the respondents, 44% admitted to theft. I went to see if there was any other sources on employee theft. I found a general psychology article (source unknown) which stated about 20% of workers are very honest and 20% of workers are very dishonest. The middle 60% tend to follow the herd. If they are working with a completely honest person, theft is minimal. However, when they work with thieves, they will often steal to the same extent as their dishonest co-worker.

Over the years, I have seen major mistakes made by honest workers. One person left spare ribs unattended on a grill to check a delivery and they were inedible. Another person decided to pre-cook a huge number of rotisserie chickens for a special promotion on a low traffic day. In both cases, the employees made mistakes which were one time events. Both of my clients said nothing to the employees. They both realized their mistakes and brought them to management's attention in the first place. Keeping records on simple waste sheets encourages this honest loss activity to be quantified and archived for future period comparisons.

It's difficult for me to leave the theft issue hanging and management often can't see how major theft is possible. However, over the years we have found managers with relatives in the pizza business filling a van with flour, cheese and canned tomatoes. A multi-unit chain in New York tracked a vendor delivery person who visited five of their stores trying to sell cases of shrimp as a "cash only" special. Someone lost the shrimp due to poor receiving controls. My first consulting client ever couldn't believe the long time chef was a thief until the employee admitted he stole two blocks of 16-20 shrimp a week.

If you believe you have reviewed and corrected all the items mentioned above and your variances still don't make sense. Review the POS setup for all menu items which call for the variance item. Look for specials, the OPEN FOOD key and buffets. You may even find the item is wrong in the system. Some companies allow managers to overwrite the menu item names on the POS. I'm not a fan of this method. The entire history is ruined with one small change.

If the operation has no issues at all, check the recipe. Maybe it really isn't correct. Sometimes the wizards make mistakes.

Friday, August 04, 2006

100% Cost Percentage?

As I entered the professionally designed coffee shop on Madison and 49th Street, my first observation was the herd of Wall Street types sipping espresso. The grand opening was in full swing. The press had done a fantastic job of getting the word out. Sales were brisk and it was difficult for my clients to hide their emotions.

As the jubilation of the busy opening faded, the reports began to show a huge cost problem in the premium bottled drinks category. These refrigerated products were available on a help yourself basis. The general manager and the vice president asked me: "Is it possible to run a 100% cost of sales?" My answer was a simple yes. They looked at me incredulously and demanded to know how items priced to yield a 30% cost of sales could possibly have a 100% figure. My answer was "Massive theft!" They agreed there might be a bottle or two taken every day by "customers" but there's no way theft could explain this level of variance.

We continued to debate the theft issue and I explained the true yield was 100% which would rule out portion issues. The items were all shelf stable which would rule out spoilage. Breakage was possible but they explained the new store had yet to suffer a broken bottle incident. So where do we find the 70% variance? I held my ground with the massive theft theory.

The offices were upstairs and we took the elevator to continue our meeting away from the operation. During our meeting I asked for the complete path a bottle would take from delivery to sale. The deliveries were approved by the morning manager and full cases were stored in a first floor storeroom near the sandwich production area. Bottles were restocked three times a day by general helpers (morning, pre-lunch and post-lunch). As our meeting broke up, I asked to visit the first floor storage area to check for locks and other security features.

As we entered the sandwich area, I noticed the four prep workers were all drinking premium bottled beverages. I asked them how they account for employee beverage consumption. The general manager told me they were allowed unlimited coffee and fountain drinks. I asked for clarification on the premium bottled beverages. The answer was the employees would have to pay for these drinks.

Indeed we found the extra 70% cost. The specialty iced teas in assorted flavors were the most popular drinks for the workers in the hot production areas. The opening was in July and the weather was sweltering and the prep area had no air conditioning unit. These workers were drinking these bottles by the case while the paying customers out front barely noticed the premium drinks cooler. Everyone was drinking barista specialties.

For those who want to know how the cost percentage could be 100%: Take a $0.45 bottle and sell 3 at $1.50 each. That's $4.50 in sales. Now subtract 7 bottles due to employee thirst. That's 10 bottles (3 sold plus 7 unsold) at $0.45 or the very same $4.50.

As the jubilation of the busy opening faded, the reports began to show a huge cost problem in the premium bottled drinks category. These refrigerated products were available on a help yourself basis. The general manager and the vice president asked me: "Is it possible to run a 100% cost of sales?" My answer was a simple yes. They looked at me incredulously and demanded to know how items priced to yield a 30% cost of sales could possibly have a 100% figure. My answer was "Massive theft!" They agreed there might be a bottle or two taken every day by "customers" but there's no way theft could explain this level of variance.

We continued to debate the theft issue and I explained the true yield was 100% which would rule out portion issues. The items were all shelf stable which would rule out spoilage. Breakage was possible but they explained the new store had yet to suffer a broken bottle incident. So where do we find the 70% variance? I held my ground with the massive theft theory.

The offices were upstairs and we took the elevator to continue our meeting away from the operation. During our meeting I asked for the complete path a bottle would take from delivery to sale. The deliveries were approved by the morning manager and full cases were stored in a first floor storeroom near the sandwich production area. Bottles were restocked three times a day by general helpers (morning, pre-lunch and post-lunch). As our meeting broke up, I asked to visit the first floor storage area to check for locks and other security features.

As we entered the sandwich area, I noticed the four prep workers were all drinking premium bottled beverages. I asked them how they account for employee beverage consumption. The general manager told me they were allowed unlimited coffee and fountain drinks. I asked for clarification on the premium bottled beverages. The answer was the employees would have to pay for these drinks.

Indeed we found the extra 70% cost. The specialty iced teas in assorted flavors were the most popular drinks for the workers in the hot production areas. The opening was in July and the weather was sweltering and the prep area had no air conditioning unit. These workers were drinking these bottles by the case while the paying customers out front barely noticed the premium drinks cooler. Everyone was drinking barista specialties.

For those who want to know how the cost percentage could be 100%: Take a $0.45 bottle and sell 3 at $1.50 each. That's $4.50 in sales. Now subtract 7 bottles due to employee thirst. That's 10 bottles (3 sold plus 7 unsold) at $0.45 or the very same $4.50.

Monday, July 31, 2006

Reuse Paper Clips

Energy prices have a significant impact on the economy. High gas prices are like a tax on the citizens each tank. Budgets need to allow for high gas prices and their impact on our industry.

In the mid-1980s, the price of a barrel of oil plunged to $5. Our clientele were put under enormous cost constraints as construction and oil exploration came to a halt. The chief operating officer in our company made a tour of the globe carrying copies of an internal memo from the largest industrial contractor. The short memo stressed cost containment at all levels and made many specific instructions including the reuse of paper clips.

We immediately changed our corporate travel and entertainment policy, created a request system for office supplies and called all contractors to renegotiate service levels. Our clients requested meetings with our contract team and we worked on change orders which guaranteed coverage of fixed costs and reduced the number of onsite managers required by contract.

Our parent company was moving away from a reliance on remote site feeding through acquisition. We started looking for acquisition targets with contracts in urban areas. During this period, I studied zero based budgeting and constructed decision packages for each department and for each acquisition target.

We were able to grow sales and profits by milking the remote site feeding cash cow and investing in less volatile urban companies.

Today, the level of activity in oil exploration is back near the peak and the Edmonton Oilers were in the 2006 Stanley Cup series. I heard a Fort McMurray Today broadcast on public radio and the person being interviewed mentioned a mean salary of $90,000 for the city. I'm sure there are articles about Edmonton's population doubling in the next five years as there were back in 1982.

Back in 1975, my college friends and I went on spring break to Florida. We needed to sit all night in Savannah to get gas since the stations had no gas until the morning delivery. It took about ten years to go from the gas embargoes to the huge drop in oil prices. During this period, oil production began on Prudhoe Bay, Colorado oil shale mines were developed in Parachute, major offshore drilling took place in Alaska, Scotland, Norway and Newfoundland.

The current run in oil prices began during the final year of the Clinton presidency and has now entered the seventh year. In 1982, there were predictions of $100 per barrel oil (vs. $35) and today we hear many dire predictions. Meantime, China is developing strict policies on energy use and America is promoting ethanol usage. Hopefully, in three more years (or less) we'll have more memos floating around demanding reuse of paper clips at the major construction companies.

In the mid-1980s, the price of a barrel of oil plunged to $5. Our clientele were put under enormous cost constraints as construction and oil exploration came to a halt. The chief operating officer in our company made a tour of the globe carrying copies of an internal memo from the largest industrial contractor. The short memo stressed cost containment at all levels and made many specific instructions including the reuse of paper clips.

We immediately changed our corporate travel and entertainment policy, created a request system for office supplies and called all contractors to renegotiate service levels. Our clients requested meetings with our contract team and we worked on change orders which guaranteed coverage of fixed costs and reduced the number of onsite managers required by contract.

Our parent company was moving away from a reliance on remote site feeding through acquisition. We started looking for acquisition targets with contracts in urban areas. During this period, I studied zero based budgeting and constructed decision packages for each department and for each acquisition target.

We were able to grow sales and profits by milking the remote site feeding cash cow and investing in less volatile urban companies.

Today, the level of activity in oil exploration is back near the peak and the Edmonton Oilers were in the 2006 Stanley Cup series. I heard a Fort McMurray Today broadcast on public radio and the person being interviewed mentioned a mean salary of $90,000 for the city. I'm sure there are articles about Edmonton's population doubling in the next five years as there were back in 1982.